The Evolution of the NVCA Documents: A Brief Description of the Changes to the Crowdsourced Gem of Venture Capital Practice1

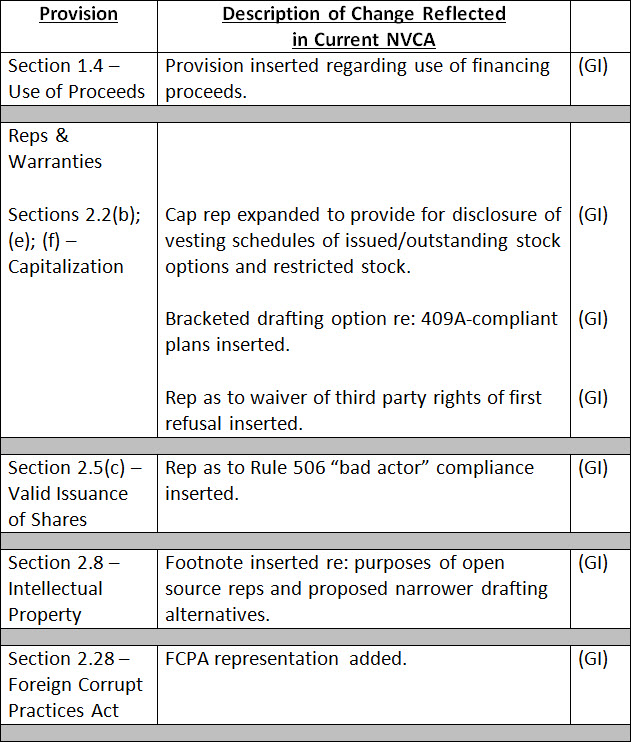

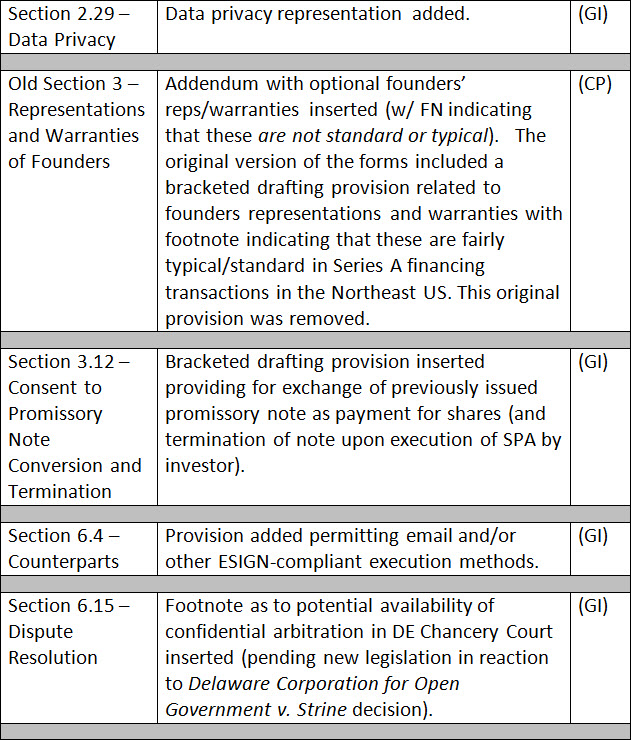

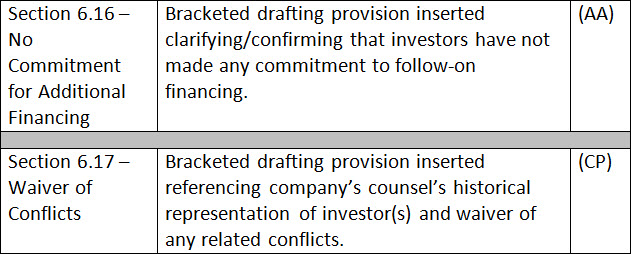

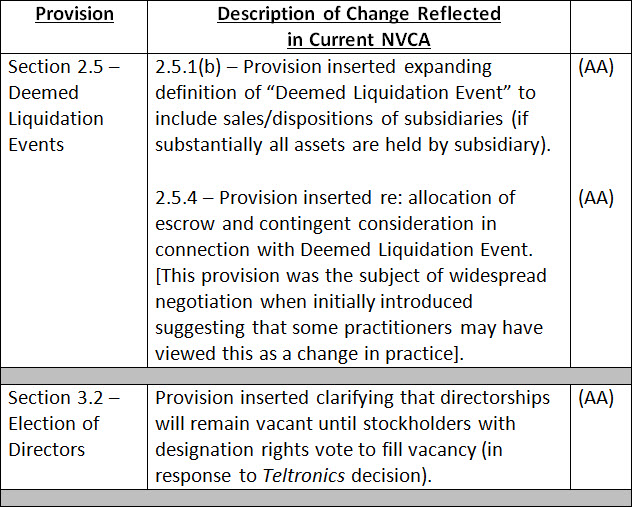

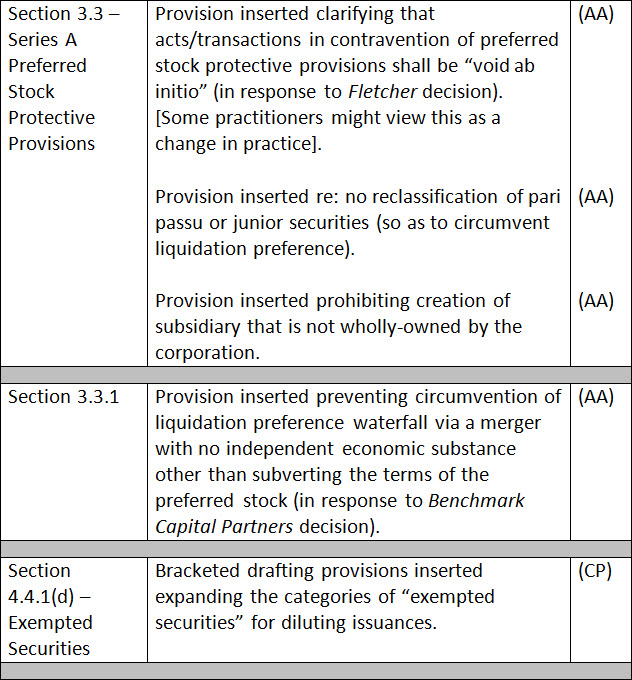

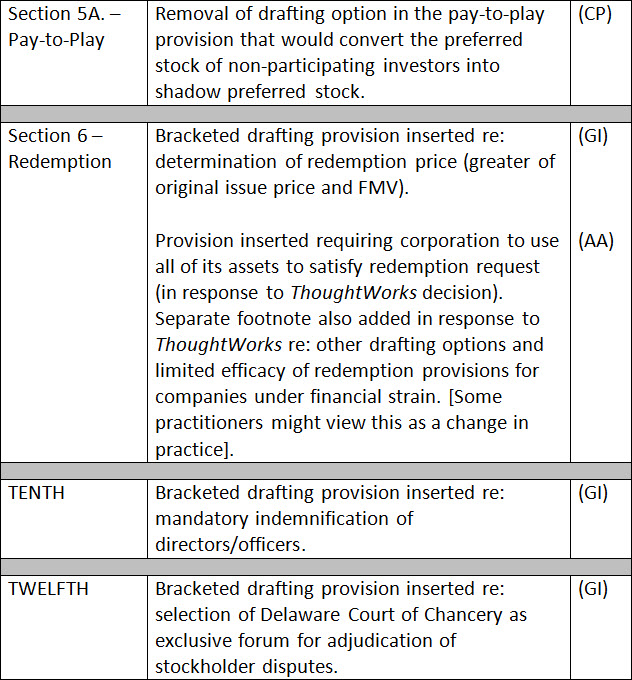

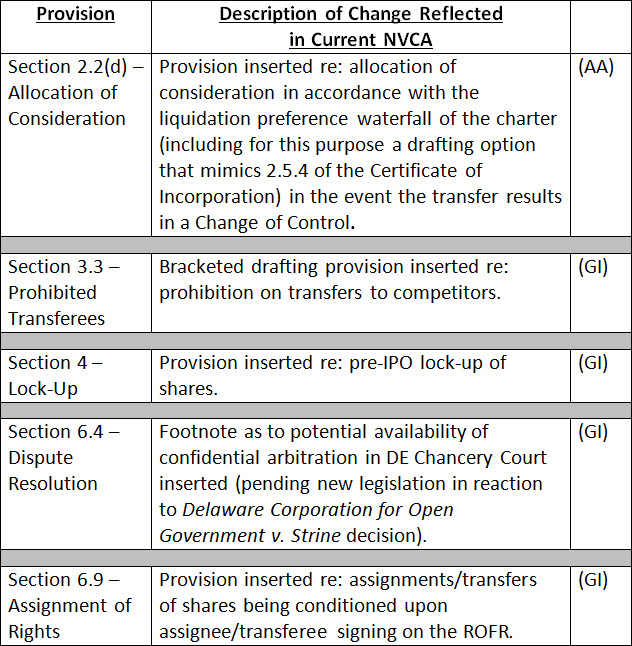

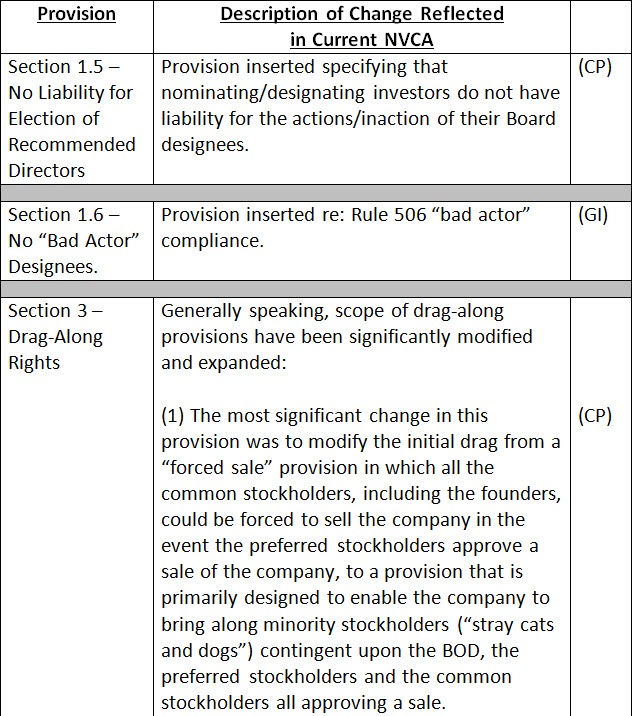

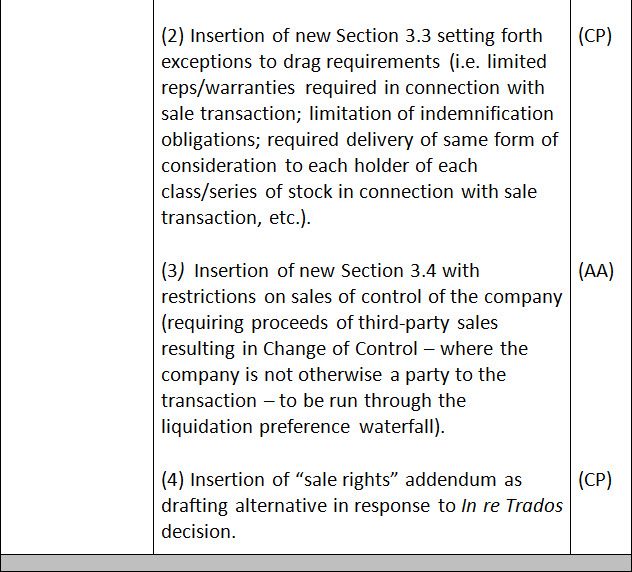

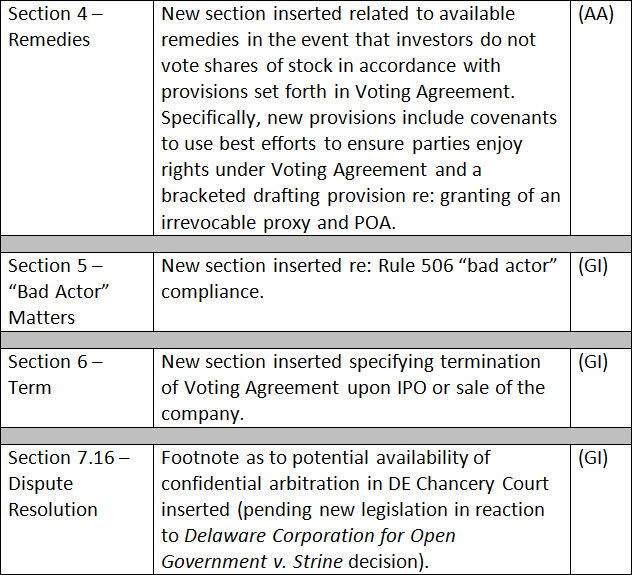

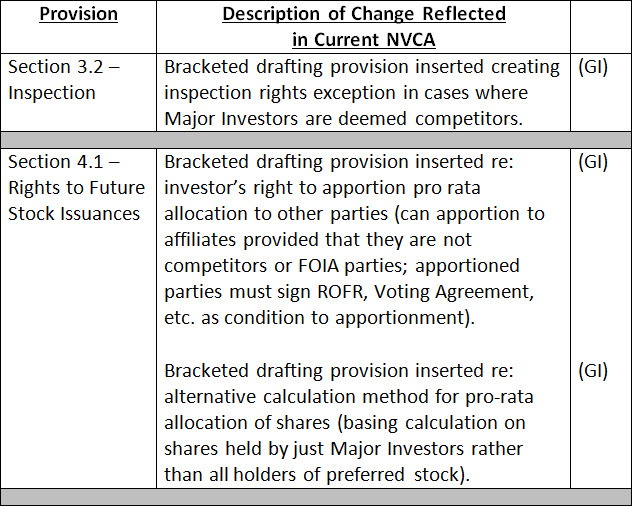

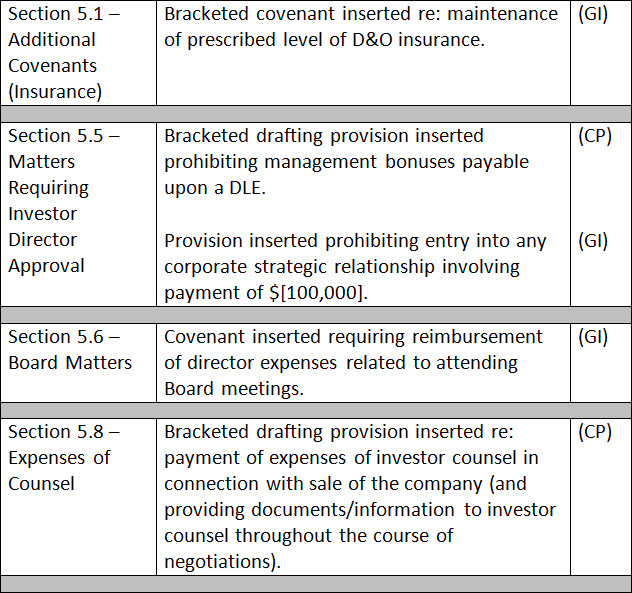

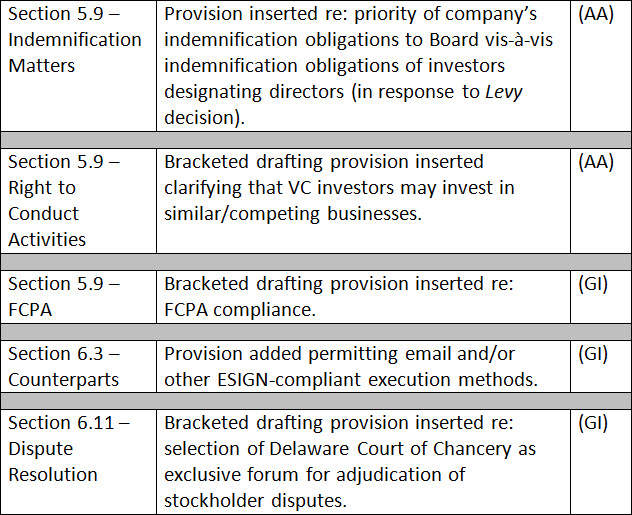

The table below is a summary of the primary changes that have been made to the National Venture Capital Association’s model venture capital documents since they were originally released in 2003.2 In an effort to assess the overall impact of these changes, we have undertaken to categorize them based on one of three underlying purposes- changes made to clarify the documents and/or eliminate opportunities for avoidance of the underlying intent; changes that reflect shifts in venture capital practice; and changes that simply reflect efforts to generally refine and improve the documents. The category in which we have placed each change identified below is indicated in parentheses following the description of such change using the following annotations:

“AA”= Anti-Avoidance/Clarifying

“CP”= Changes in Practice

“GI” = General Improvements

Practitioners might disagree as to how the various changes highlighted below should be characterized. We have indicated in certain places in the table where the decision we made seemed particularly susceptible to two different characterizations. Not surprisingly, how a change should be characterized – and more specifically whether it is a substantive change or not – depends largely on the perspective of the reader and the prior understanding the reader brings to the document regarding the intent of the relevant provision both before and after the change was introduced. This perspective is likely shaped by whether the practitioner is bringing an “investor friendly” or “company friendly” orientation to the exercise. We have endeavored to be objective. We have also been selective in the changes that we have highlighted. The NVCA drafting committee has been meticulously and painstakingly updating these documents for over a decade. Itemizing and characterizing all these changes was beyond the scope of this exercise. We have no doubt itemized certain changes that may not be as substantial as other changes that we have chosen to omit from the list.

A disproportionate number of the changes that have been made, and that are listed below, may best be described as “general improvements” rather than clarifying changes or changes to reflect new practice. These changes reflect refinements in the documents based on venture capital practitioners’ evolving understanding of the terms and conditions in practice, coupled with upgrades to reflect legal developments. Many of these general improvements are simply in the form of additional drafting options that reflect the creative alternatives that have crept into common practice and can be helpful in working through issues that come up in negotiations during the documentation phase of any venture capital transaction.

Many of the changes have been driven by developments in the law. Changes that were introduced in response to developments in the law fall into all of the above categories, with certain of these changes designed to clarify, or close off anti-avoidance opportunities, that were exposed as a result of litigation (e.g., Benchmark; Levy; Fletcher; ThoughtWorks), other changes reflecting changes in practice that are in reaction to these legal developments (e.g., Trados), and still a third group falling into the category of general improvements necessitated or informed by these legal developments (e.g., Rule 506 “bad actor” provisions).

The nature of the changes that reflect shifts in practice suggest that the NVCA forms have been evolving in a direction that is more “friendly” to the company and its founders. For example, the stock purchase agreement no longer provides for founder representations and warranties, and a footnote indicates that such representations and warranties are not standard. In addition, the drag along feature has been substantially modified from the original “forced sale” provision, which would allow the preferred stockholders to unilaterally decide when to invoke the drag, to a provision that now requires each of the board of directors, the preferred stockholders and the common stockholders to be in general agreement before the drag may be triggered. While there have been new provisions introduced that reflect a practice shift in favor of investors as well, most of these changes appear to relate either to issues of secondary commercial importance, or are in the form of drafting options intended to flag issues for consideration rather than establish a new standard of practice.

Regardless of whether practitioners agree with the modifications that have been made over the 10 plus years, or not, the deliberate process the NVCA model forms committee has gone through in updating and modifying these documents has resulted in a product that is a must-have resource to any venture capital practitioner. A careful review of the changes reveals just how deliberate and exacting an effort this has been. The forms are the byproduct of a unique, cooperative effort undertaken by many of the most experienced and sophisticated venture capital practitioners in the country. Today this cooperative effort, and the collection of input and know-how it involved, would accurately be called “crowdsourcing.” But the forms project was an effort that started well before such term was in vogue. In this regard, the project was ahead of its time. Lawyers who proceed with venture capital transactions without using these forms at some level, even if just as a reference resource, do so at their own peril given the depth of knowledge and insight they contain. We should all be thankful such a resource exists, and hope that the documents continue to be maintained with the same standard of care so that practitioners continue to have access to this invaluable tool. In the end this will allow our clients to get to the intended result of the negotiated for bargain as efficiently as possible. That is the ultimate goal.

TABLE

Stock Purchase Agreement

Certificate of Incorporation

Right of First Refusal and Co-sale Agreement

Voting Agreement

Investors’ Rights Agreement

1. © Copyright 2015, Jonathan D. Gworek and Scott R. Bleier. Thanks also to Sarah Reed, General Counsel and Chief Operating Officer of MPM Capital and founding chairperson of the NVCA model venture capital documents initiative, for offering her comments and historical perspective to this article.

2. Updated documents were taken from the NVCA website on March 16, 2015, and compared to the forms originally posted in December, 2003. While this article focuses just on changes since the initial documents were posted in 2003, that initial set of documents was itself the byproduct of an exhaustive, de novo review of prevailing venture capital documentation and reflected a number of significant changes in practice at that time. For example, the initial SPA adopted a much simpler set of representations and warranties following an exercise in which representations considered more appropriate for M&A transactions were stripped out. Also, noticeably missing from the initial NVCA Certificate of Incorporation was the “no-impairment” clause which was eliminated because it was viewed as “the last refuge” for parties who felt aggrieved but had no substantive rights to assert.